First Home Super Saver Scheme (FHSSP)

The FHSS (First Home Super Saver) Scheme was introduced by the Australian Government to reduce pressure on housing affordability. The FHSS scheme allows individual to save money for their first home inside individual superannuation fund.

Below list details about FHSS Scheme

- From 1 July 2017: individuals can make voluntary concessional (before-tax) and non-concessional (after-tax) contributions

- From 1 July 2018 individuals can apply to release the voluntary contributions. Following eligibility criteria applies

You must be over 18 years old to request a release of funds

Have never owned property in Australia including investment property, vacant land, commercial property, a lease of land in Australia, or a company title interest in land in Australia (exception: unless the commissioner of Taxation determines that you have suffered financial hardship)

Have not previously requested the Commissioner to issue a FHSS release authority in relation to the scheme

- You can use this scheme if you are a first home buyer and both of the following apply

Either link in the premises you are buying, or intend to as soon as practical

Intend to live in the property for at least six months of the first 12 months you own it, after it is practical to move in

You can apply to have maximum of $15,000 of your voluntary contributions from any one financial year included in your eligible contributions to be released under the FHSS scheme, up to a total of $30,000 contributions across all years.

- Three key things to remember are

You can only apply for release once

Do not sign contract to purchase or construct your home until after funds have been released

It will take roughly 25 business days to receive the funds

Refresh & Renew with UpHill

|

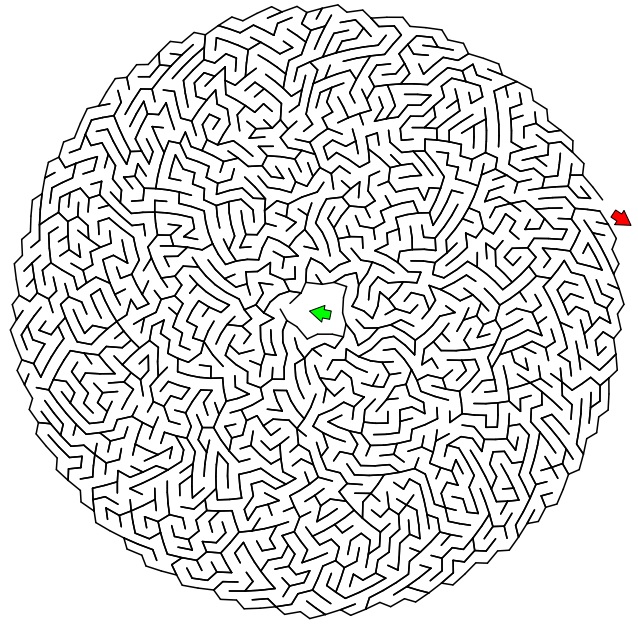

COLOR ME !!!!!!

|

|

|

Source: Justcolor.cnet, puzzles.ca, krazydad.com & ATO Website (https://www.ato.gov.au/Individuals/Super/Super-housing-measures/First-Home-Super-Saver-Scheme/#Eligibilityforthescheme1)