Stay informed and up to date on the real estate market in Belmont and surrounds:

Property values change with the market, and smart investors and sellers keep their finger on the pulse.

Subscribe to receive market updates to your inbox.

First Home Super Saver Scheme (FHSSP)

The FHSS (First Home Super Saver) Scheme was introduced by the Australian Government to reduce pressure on housing affordability. The FHSS scheme allows individual to save money for their first home inside individual superannuation fund.

Below list details about FHSS Scheme

- From 1 July 2017: individuals can make voluntary concessional (before-tax) and non-concessional (after-tax) contributions

-...

READ MORE

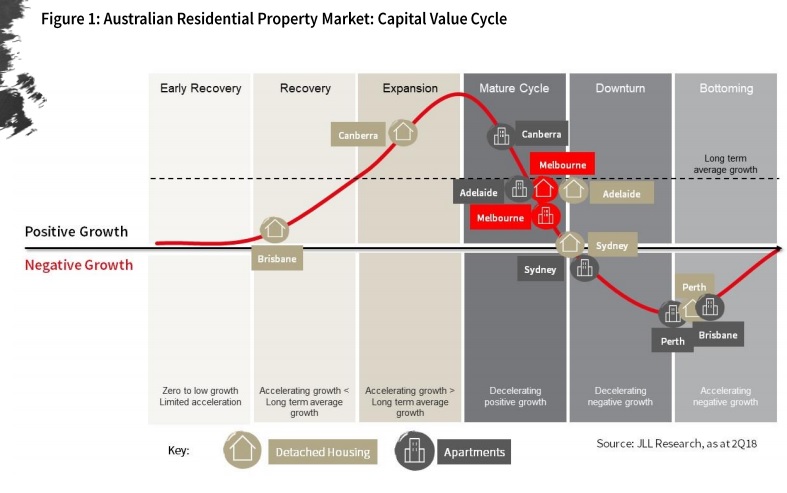

Melbourne Housing Market Overview

September 2018

Melbourne dwelling prices and rents have held up better than expected at this late-stage in a strong cycle. Residential market has clearly softened, and price growth has stalled. These decreasing sales volumes largely reflects a significant decline in investor purchaser activity.

New Laws that affects Rental Properties

We are focusing on the new laws that came into effect recently that affects rental homes in Victoria. If you currently have a rental property or planning on getting your first investment property, we hope below information will benefit you

There are new laws passed that affect rental properties in Victoria. These changes are classified as the biggest change to the Residential Tenancies Act since it was implemented more than two decades ago. Below list some of the core changes that affect rental properties

Did you know that more than 1 in 4 Victorian&rsquo...

READ MORE

Changes to the way GST is paid for Property Settlements

The ATO changed the way it collets Goods and Services Tax (GST) on some property transactions from 1st of July 2018.

From 1st of July, some purchasers of new residential premises or potential residential land will need to withhold an amount from the purchase price and pay it directly to the ATO. Vendor will receive a credit for this amount when vendor lodges their Business Activity Statement (BAS) for the tax period.

GST on settlement was announced in the 2017/18 Federal Budget

There is NO change to the rate of GST, the change is to the way the ATO collects the GST. How it works,

- &...

READ MORE

Property Prices double every decade?

There is a notion that property value in Australia double in every 10 years. Below is an extract from a study conducted to investigate this notion

Home values across the combined capital cities in Australia have increased by a total 72.0% over the 10 years to January 2016 which is short of values doubling over the decade. The value of houses increased by 73.1% compared to units which increased by 64.3% during this period. Melbourne is the only capital city housing market in which home valu...

READ MORE

19 Nov 2018

13 Oct 2018

29 Sep 2018

13 Sep 2018

30 Aug 2018

26 Jul 2018

26 Jul 2018

Get in touch to learn more about current market trends and conditions and local property sale and rental values.